Hey there, my fellow electric car enthusiasts! I’ve got some great news for you today about the federal EV tax credit for 2022 and 2023. You may be wondering which vehicles qualify and how the credit works, so let’s dive in!

EV Tax Credit: 2022 & 2023

First and foremost, let's discuss the basics. The federal electric vehicle tax credit is an incentive provided to new EV buyers that reduces the cost of purchasing an electric car. This tax credit is applicable to vehicles purchased after December 31, 2009.

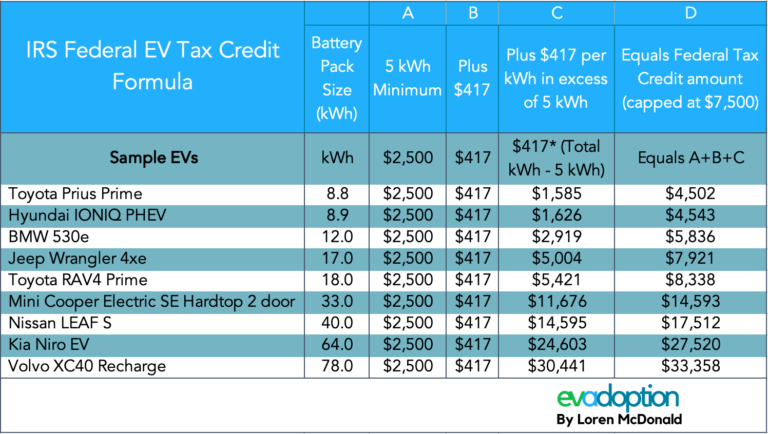

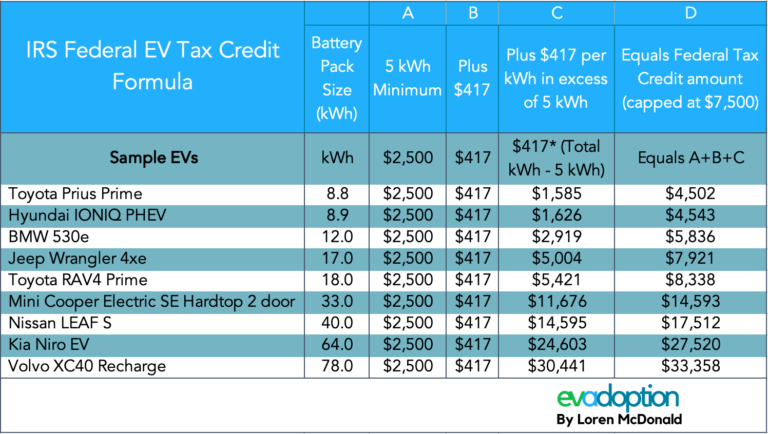

As of 2021, the federal tax credit for electric vehicles ranges from $2,500 to $7,500. However, it’s important to note that not all cars qualify for the full amount. The amount of the credit is dependent on the vehicle's battery size and the manufacturer.

Starting in 2022, electric cars with a range of over 200 miles will qualify for the full $7,500 credit while vehicles with a range between 150 and 200 miles will reduce the credit by $50 for every kWh of battery capacity that exceeds 50 kWh. Additionally, hybrid vehicles will no longer be eligible for the credit.

Now that we’ve got the basics covered, let’s take a look at which specific cars qualify for the credit!

Which Cars Qualify & How It Works

If you’re in the market for an EV, it’s important to know which vehicles qualify for the federal tax credit. Some popular options include:

- Tesla Model 3, Model S, and Model X (credit is phased out for Teslas that were ordered after December 31, 2019)

- BMW i3

- Ford Mustang Mach-E

- Chevrolet Bolt EV

- Volkswagen ID.4

These are just a few examples, so make sure to do your research to see if the car you’re interested in qualifies for the full credit!

It’s also important to note that the federal tax credit is non-refundable. This means that if the amount of the credit exceeds your tax liability, you won’t receive the remaining amount in cash. However, you can carry over the unused portion of the credit to the following year’s tax return.

Fixing the Federal EV Tax Credit Flaws: Redesigning the Vehicle Credit

Despite the benefits of the federal EV tax credit, some flaws have been noted. One of the most significant criticisms is that the credit is limited to the first 200,000 vehicles sold by each automaker.

This means that popular manufacturers like Tesla and General Motors were the first to reach the quota, making their vehicles ineligible for the full tax credit. This puts popular EV manufacturers at a significant disadvantage compared to newer manufacturers who haven’t reached the quota yet.

To address this issue, several proposals have been made to redesign the vehicle credit system. One proposal suggests eliminating the quota altogether and replacing it with a cap on the maximum credit amount per manufacturer.

Another proposal suggests reducing the credit amount over time, allowing more people to benefit from the credit and promoting EV adoption. While these proposals are still in discussion, it’s great to see that lawmakers are working to make the EV tax credit more accessible and equitable.

Is the 2022 Hyundai Ioniq 5 Eligible for the Federal EV Tax Credit?

One question that many EV enthusiasts have been asking is whether the 2022 Hyundai Ioniq 5 is eligible for the federal tax credit. The answer is YES!

The 2022 Hyundai Ioniq 5 has a range of over 200 miles, making it eligible for the full $7,500 federal tax credit. This car has quickly become a popular option for EV buyers, and it’s great to see that it qualifies for the full credit.

Electric Cars Qualify For The EV Tax Credit

If you’re in the market for an EV, it’s important to take advantage of the federal EV tax credit. This incentive can significantly reduce the cost of purchasing an electric car and help make the technology more accessible to a wider audience.

Remember, not all EVs qualify for the full $7,500 credit, so make sure to do your research and find a car that fits your needs and budget. With the continuous advancements in EV technology, there’s never been a better time to go electric!

Tax Credits For Electric Vehicles

If you’re still unsure about how the federal EV tax credit works, don’t worry – you’re not alone. The good news is that there are resources available to help you navigate this process.

One tool that can be especially helpful is the Electric Vehicle Tax Credit Form 8936. This form provides instructions on how to claim the credit and calculate the amount of the credit you’re eligible for.

Additionally, consulting with a tax professional can ensure that you’re making the most of the tax credit and not overlooking any other incentives or deductions that you may be eligible for.

These Electric Cars Qualify For The EV Tax Credits

Looking for more EV options that qualify for the federal tax credit? Here are a few more great options:

- Nissan Leaf

- Kia Niro EV

- Jaguar I-PACE

- Audi e-Tron

- Volvo XC40 Recharge

These options are just the tip of the iceberg – there are plenty of other EVs out there that qualify for the tax credit. Don’t forget to factor in additional incentives and rebates offered at the state and local level!

So, there you have it – everything you need to know about the federal EV tax credit for 2022 and 2023. With so many great options available, now is the perfect time to make the switch to electric and start enjoying the benefits of sustainable transportation!

If you are searching about Is the 2022 Hyundai Ioniq 5 Eligible for the Federal EV Tax Credit? you've came to the right page. We have 8 Pictures about Is the 2022 Hyundai Ioniq 5 Eligible for the Federal EV Tax Credit? like Fixing the Federal EV Tax Credit Flaws: Redesigning the Vehicle Credit, EV Tax Credit: 2022 & 2023 - Which Cars Qualify & How It Works and also Is the 2022 Hyundai Ioniq 5 Eligible for the Federal EV Tax Credit?. Here it is:

Is The 2022 Hyundai Ioniq 5 Eligible For The Federal EV Tax Credit?

www.motorbiscuit.com

www.motorbiscuit.com Global Vehicle Sales Drop In Coming Years, Oil Demand Rises: IHS Markit

sales ev tax credit tesla rises demand markit ihs drop coming vehicle global oil years electric likely dropping impact vehicles

These Electric Cars Qualify For The EV Tax Credits | 15 Minute News

www.15minutenews.com

www.15minutenews.com Electric Cars Qualify For The EV Tax Credit - Best Electric Vehicle

bestev.co.in

bestev.co.in These Electric Cars Qualify For The EV Tax Credits » InfoEVs

infoevs.com

infoevs.com Fixing The Federal EV Tax Credit Flaws: Redesigning The Vehicle Credit

evadoption.com

evadoption.com flaws redesigning fixing evadoption

Tax Credits For Electric Vehicles - TaxProAdvice.com

www.taxproadvice.com

www.taxproadvice.com EV Tax Credit: 2022 & 2023 - Which Cars Qualify & How It Works

www.findmyelectric.com

www.findmyelectric.com Fixing the federal ev tax credit flaws: redesigning the vehicle credit. These electric cars qualify for the ev tax credits. These electric cars qualify for the ev tax credits » infoevs

Post a Comment

Post a Comment